Arizona’s universities powering a startup surge with funding, innovation

Arizona’s universities are driving the state’s startup boom by providing funding, mentorship, and resources to help new businesses thrive.

Arizona’s universities are helping fuel the state’s startup boom, with local experts discussing last week public institutions' role in shaping the future of entrepreneurship.

During Thursday’s TENWEST Fest session, “Investing in Arizona’s Future: How University-Linked Funds Are Shaping the Startup Ecosystem,” Tech Launch Arizona’s Doug Hockstad, UAVenture Capital’s Fletcher McCusker, and ASU Enterprise Partners’ Louise Hardman talked about why investing in university-affiliated startups and graduates is a smart bet for investors and the state.

Arizona’s universities are playing a key role in providing not only funding but also mentorship and resources to help startups thrive. As the state continues to expand its footprint in innovation, university-linked funds have become critical in fueling the next wave of businesses.

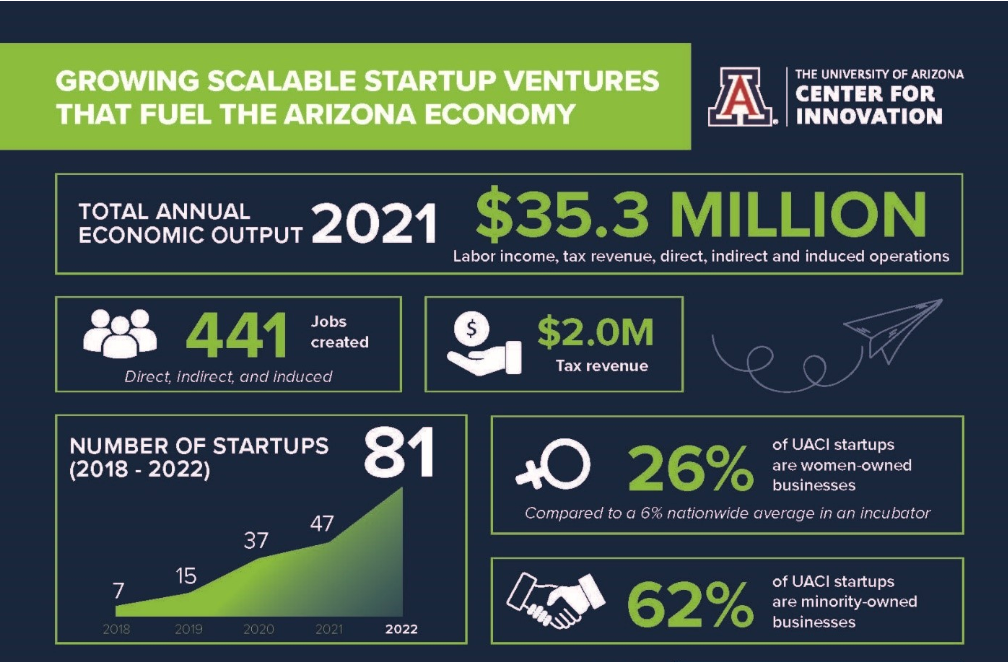

A local example of this is the University of Arizona’s Center for Innovation. From 2021 to 2023, the center created 886 jobs and generated $19.2 million in tax revenue.

The center has also been especially helpful in supporting startups, with 41% of its ventures being led by UA alumni, students, or tech transfers of research from creators to users.

These startups have raised a collective $38 million in capital, secured $33 million in grants, and generated $24 million in revenue, with industries including healthcare, biotechnology, life sciences, and climate tech driving this force.

Since its inception, the center has had a lifetime impact of $180.6 million, supported more than 300 startups, and empowered over 1,500 entrepreneurs. This track record underscores the vital role the center plays in Arizona's entrepreneurial ecosystem.

Tech Launch Arizona’s Hockstad explained that one of the biggest challenges for university-affiliated startups is the “valley of death,” or the gap many startups face after receiving initial seed funding but before they attract larger rounds of venture capital.

He said university research often leads to groundbreaking discoveries, but startups coming out of these discoveries often struggle to move beyond the early stages.

Hockstad described these companies as “the walking dead.”

“They’re alive, but without funding, they’re barely moving forward,” he said.

To help fill the void, Tech Launch created a philanthropic seed fund to address that valley of death and help get companies through the next steps.

The Wildcat Philanthropic Seed Fund has already raised $2.5 million of its $5 million goal. The fund provides early-stage funding between $25,000 and $150,000 to help startups grow and eventually attract larger investments.

The initiative is aimed at ensuring that university-backed startups don’t stagnate due to a lack of capital.

ASU Enterprise Partners serves a similar purpose in helping to foster the growth of Arizona State University’s startup ecosystem through the school’s venture network, including its corporate venture capital arm, Rome Spark.

"We give them access to one of the largest universities in the world and help them test and refine their products until they're really ready to scale," said ASU Enterprise Partners' Hardman.

ASU’s model is different from UA’s approach, as ASU facilitates direct investments from angel investors and venture capital firms rather than pooling funds into a single university fund.

Hardman said one of the biggest challenges for faculty inventors is that many of them are brilliant researchers but not natural entrepreneurs.

To help overcome this, ASU connects these inventors with experienced business leaders who can help guide them through the process of scaling their startups. This combination of access to funding and expertise has proven successful, with Hardman noting that eight out of 16 companies presented to investors through ASU’s network received funding last year.

One of ASU’s notable successes was a healthcare startup that secured $450,000 in seed funding through ASU’s network and later raised an additional $8 million in equity investments. This example highlights the potential for university-backed startups to grow and attract significant investments with the right support and guidance, Hardman said.

UAVenture Capital’s McCusker said his firm has long supported early-stage startups coming out of Tucson. Since its inception, UAVenture has invested more than $40 million in UA-led startups, focusing on a wide range of sectors such as space technology, defense, and biomedical research.

UAVenture also provides mentorship and long-term support, with McCusker telling attendees that every company UAVenture has backed is still in operation.

One of the major challenges faced by university-affiliated startups is the inability of universities to own equity in the companies they help create, McCusker said. This restriction is due to a 2004 amendment to state law prohibiting public universities from holding equity stakes in the startups that emerge from their research and innovation.

To work around this, McCusker and others involved in university-linked funds have had to develop creative solutions, including the creation of external, university-affiliated entities like the UArizona Foundation to manage investments and ownership structures.

These groups act as intermediaries, enabling universities to provide support to startups without directly holding equity themselves.

"(The UA) actually pay a significant amount of money every year to the state because we make money on tech transfer,” Hockstad said, highlighting another challenge. “There is not another university or state in the union that does that."

McCusker said Tucson’s growth as a tech hub is due in part to the continued collaboration between the UA and local entrepreneurs. He said that for Arizona’s startup ecosystem to continue thriving, it’s critical for the state’s universities to work together and pool resources in support of innovation.

McCusker also pointed to the importance of face-to-face commitment in the startup world.

He recalled an entrepreneur who showed up at his house to pitch an idea after failing to get a response via email. The persistence impressed McCusker, and that startup is now in UAVenture’s pipeline.

McCusker encouraged aspiring entrepreneurs to be persistent, saying, “Tell your story, don’t take no for an answer, and prove that you’re all in.”

Angelina Maynes is a University of Arizona alum and reporter with Tucson Spotlight. Contact her at angelinamaynes@arizona.edu.

Tucson Spotlight is a community-based newsroom that provides paid opportunities for students and rising journalists in Southern Arizona. Please support our work with a paid subscription.